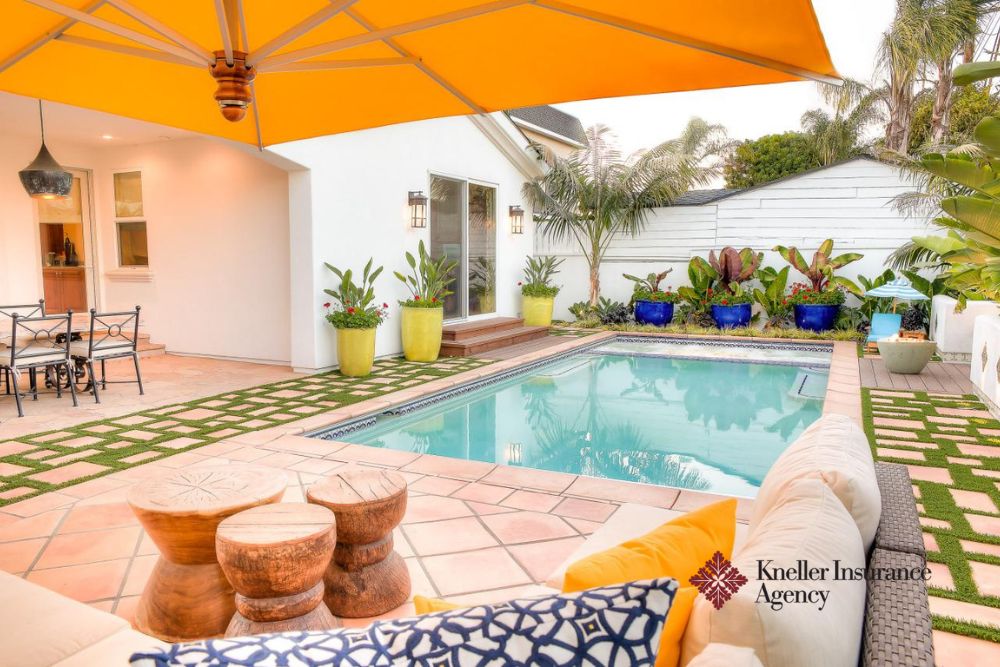

Owning a vacation home is a dream for many, offering a serene escape from the hustle and bustle of everyday life. Whether it's a cozy cabin in the woods, a beachfront property, or a lakeside retreat, your vacation home is a valuable asset that deserves protection. Insuring your vacation home is a smart move that ensures your investment is safeguarded against unforeseen events. Let's explore why insuring your vacation home is essential and provide tips on how to best protect your property.

New York has some of the most sought-after vacation spots, from the scenic Adirondacks to the Hamptons' luxurious beaches. Owning a vacation home in New York comes with unique risks, such as harsh winters, potential flooding, and seasonal property use. A specialized vacation home insurance policy can cover these risks, protecting your home, personal belongings, and liability. Without this coverage, you could face significant out-of-pocket expenses for repairs or legal claims.

If your vacation home is located outside of New York, it's essential to understand the insurance requirements and risks specific to that location. Different states and regions have varying environmental hazards, such as hurricanes, wildfires, or earthquakes. Insuring your vacation home with a policy tailored to the risks of the area ensures that you're fully covered. Additionally, insurance policies outside New York may have different terms and conditions, so working with an experienced insurance agency can help you navigate these complexities.

Some homeowners decide to convert a primary residence or apartment into a secondary vacation home. If you're considering this, updating your insurance policy to reflect the change is crucial. Standard homeowners insurance typically doesn't provide adequate coverage for a home that is no longer your primary residence. By informing your insurance provider and adjusting your policy, you can protect your vacation home properly. This may include additional coverage for rental income if you plan to lease the property when not in use.

Insuring your vacation home is not just a smart move—it's a necessity to protect your investment. Whether your property is in New York or elsewhere, Kneller Insurance Agency can help you find the right coverage tailored to your needs. Our experienced team will guide you through the process, ensuring your vacation home is protected against any risks. Contact us today to safeguard your valuable property. Call us at 518-392-9311 for a quick consultation.